Incidents & Resilience Unit Annual Report 2023/24

FSA 24/06/06 - Report by Junior Johnson

1. Summary

1.1 This paper is the annual report from the incidents and resilience unit covering the prevention and management of food incidents. It describes the increasing challenges with incident management and how we are enhancing our capability to respond, including preparation for the implementation of the Border Target Operating Model (BTOM).

1.2 The Board is asked to:

Consider and comment on:

- The work of IRU since the 2022/23 Annual update to the Board.

- The unit’s self-assessment of readiness for large scale crises and,

- How IRU is preparing to respond to the challenges we will face in the coming year.

2. Introduction

2.1 This paper provides the annual report to the Board on the activities of the FSA’s Incidents and Resilience Unit in 2023/24, including details on response, prevention and resilience. This includes:

- Incidents and Outbreaks during 2023/24

- Incident and Outbreak Challenges

- Signals and Prevention Activities

- Root Cause Analysis

- Industry Engagement

- Preparedness and Resilience

- Forward Look

2.2 The teams across England, Wales and Northern Ireland protect UK consumers by managing a 24/7, 365 incidents (footnote 1) management system. We coordinate the FSA’s response to food and feed safety incidents and foodborne disease outbreaks. We also respond, when required, to major cross Government crises, ensuring that food and/or feed that presents a safety risk is removed from the market.

2.3 The primary function of the incident management role is to ensure that products not compliant with relevant safety legislation are removed promptly from the market. Where an incident may involve potential criminality, as required the IRU will refer work to the National Food Crime Unit (NFCU), the FSA’s dedicated law enforcement capability.

2.4 Incidents require coordination across multiple partners to aid resolution. Typical FSA stakeholders for incidents management include UKHSA, DHSC, Defra, APHA, Local Authorities, Food Business Operators, other countries Incidents Management teams and more. (see Annex A Fig 1)

3. Incidents and Outbreaks during 2023/24

3.1 The FSA was notified of 1837 food and feed safety incidents in England, Northern Ireland and Wales during 2023/24. This represents a 10% decrease when compared to 2022/23 (Fig 3) and the lowest recorded over the last six years. The volume of annual incidents fluctuates for a number of reasons including but not exclusive to the introduction of new regulations, changing trends in consumer behaviour and or news and media stories. The total number of incidents does not correlate to the resource needed to bring an incident to a conclusion, incidents vary in complexity and can vary in time to resolution. Work is underway to develop reporting that captures the resource impacts of individual incidents to help assess the agency’s capacity requirements.

Total number of incident notifications received by the FSA, by reporting year.

3.2 The top four hazard types for incidents notified to the FSA in 2023/24 were Pathogenic Micro Organisms (451), Allergens (240), Food Additives & Flavourings (146) and Poor or Insufficient Controls (136). (Fig 4).

Top-eight incident notifications by incident type.

Outbreaks and Clusters of Interest (COI)

There was a total of 55 outbreaks (footnote 3) and incidents of foodborne disease. Listeria monocytogenes was the most commonly occurring pathogen, a change to the previous years where Salmonella (footnote 4) was the most commonly occurring cluster of interest. (Fig 5).

3.3 There has been an increase in Listeria related incidents during 23/24. Listeria poses serious health issues for vulnerable groups and there have been a small number of fatalities this year (Fig 5). Responding to these quickly is important to ensure public health is protected which is why the threshold for triggering action is lower compared to other pathogens. There are several examples of listeria outbreaks in 23/24 that impacted vulnerable consumers, such as a smoked salmon supplier, foodborne illnesses linked to a healthcare setting, a manufacturer of ready-to-eat chicken supplied to a sandwich supplier and a raw cheese maker. (See Annex B for case study).

STEC Outbreaks and COIs

3.4 The number of foodborne illness related incidents the FSA has responded to with partner public health agencies have remained relatively stable. There have been notable changes in trends amongst some of the key pathogens that has resulted in outbreaks being declared including listeria and norovirus. Climatological factors are key for these fluctuations with heavy rainfall being a likely key to any risk of norovirus contamination. There were 24 Shiga toxin producing E. Coli (STEC) outbreaks reported to the FSA, 12 being non-O157 strains following improved laboratory detection. We are exploring approaches adopted by other countries to understand which of their practices could be implemented to benefit the protection of UK public health. (Fig 6)

3.5 A non-routine incident response was invoked in December 2023 to mitigate potential risks from imports of Polish poultry products contaminated with salmonella. As a result of joint data analysis and prioritisation between FSA and UKHSA, an issue in public health was identified and escalated, and a preventative approach was taken. Following positive evidence, the response was de-escalated in Feb 2024. See Annex C for case study.

4. Incident and Outbreak Challenges

4.1 We are seeing an increasing number of complex incidents that require working across interorganisational boundaries with partners to seek resolution. This is evidenced by increases in potentially fatal Listeria & STEC outbreaks, which require urgent action to find the source of infection and resulting resource demands occur across Agencies. To further enhance our response to current and future challenges we have started to implement smarter ways of working and utilising up to date tools, systems and artificial intelligence to support incident activities.

4.2 Laboratories in England are enhancing detection techniques for E. Coli STEC in human cases as a priority. We therefore expect to see a continual rise in detection of widespread pathogenic STEC foodborne illness and outbreak investigations. This may cause continued, and potentially increased prioritisation challenges if resource demand exceeds capacity which is the subject of considerations as part of our Incident and Outbreak Modernisation work to address roles and responsibilities.

4.3 IRU with the Border Target Operating Model (BTOM) programme has been assessing the potential impacts on incident capacity in the lead up to the implementation of the new checks at the border (as of 30th April 2024). As a result of the scenario planning and modelling work, the agency has a better understanding and preparedness for downstream impacts of increased checks, which will ensure public safety and continued trust in the system.

5. Signals and Prevention Activities

5.1 During 2023/24, the team processed 13,216 signals. This resulted in 26 new incident and product referrals that required action and removal from the market, 86 referrals for investigation to LAs and other authorities to investigate and 1061 signals that were referred ‘for information’ to other areas of the FSA. Signals are shared routinely with Other Government Departments (see further signal descriptions in Annex C).

5.2 We have seen a rise in signals and the number of illegal 'grey market’ goods (goods not intended for the UK market) from the US which made up 5% of incidents in 23/24. This is concern due to the goods not being compliant with UK food safety additive laws. Lack of clarity in legal powers needed to tackle the issue had led to the current incidents & enforcement arrangements not being effective in dealing with this issue and the supply and sale of grey goods widespread at retail outlets and online. We initiated a co-ordinated cross Agency enforcement approach including communications to business and consumers. See Annex C for a case study.

5.3 We continue to engage with INFOSAN (the International Food Safety Authority Network) albeit with a reduced influence following withdrawal of the FSA seconded post, which means the FSA has less direct access to influence strategic priorities. We continue to exchange notifications of food & feed safety risks with other countries using INFOSAN in the absence of full access to the Rapid Alert System for Food and Feed (RASFF). International engagement included discussions of food safety issues authorities from US, Turkey and Republic of Ireland. The FSA has recently secured the Trade and Cooperation agreement for direct discussion on large scale incidents and outbreaks with the EU Commission, which means we no longer have to hold bilateral engagements with individual countries.

6. Root Cause Analysis (RCA)

6.1 Root Cause Analysis (RCA) is a method for FSA and Food Business Operators (FBOs) to improve the understanding of why incidents and outbreaks occur. RCA also helps to identify vulnerabilities, enabling authorities and FBOs to put mitigations in place to prevent future occurrence. The FSA requests RCAs from FBOs for qualifying incidents which include, all alerts, allergy incidents and pathogenic organism incidents. Over 255 RCAs were received from businesses involved in incidents over the period which is a reduction from last year’s figure of 325. A Summary report for 2023/24 is included in Annex D to give a high-level illustration of RCA categorisations.

6.2 Undeclared milk allergen incidents and Salmonella incidents were the two key incidents trend areas from this year’s RCA report. For undeclared milk allergen incidents, the main cause (53%) was due to ‘errors in process’. This can be illustrated by the example of an ingredient containing milk not being declared on the label. For Salmonella in foods the main cause (55%) was related to ‘errors in materials’, this could include chicken being contaminated by Salmonella prior to arrival at the business, but not detected and leading to cross contamination during further processing.

6.3 In order to maximise learning from these detailed Root Cause Analyses, IRU established a working group, to improve RCA collection, technical interpretation and dissemination. The group is chaired by an independent industry expert with FSS and industry representation. The group looks into RCA data depending on identified trends, with learnings to be shared with industry. For example a trend in incidents following an FSA sampling survey led to a trade article being published related to undeclared peanut in spices from Africa in the April 2024 GAFTA trade newsletter with a circulation of over 3000 businesses across 100 countries.

7. Industry engagement

7.1 The Head of Incidents chairs the Food Industry Liaison Group (FILG) and aims to build industry trust and reduce occurrences of incidents. This forum facilitated prevention work on Listeria in Enoki Mushrooms, an issue linked to fatal outbreaks in the US and Canada. Intelligence was shared with UK industry, enabling businesses to take quicker action, enabling enhanced scrutiny and surveillance of their own supply chains. This led to an increase in planned audits, reducing food safety risks resulting in enhanced consumer protection. Although incidents resulted from increased surveillance, no illnesses were reported which can be seen as a successful outcome.

7.2 FSA led several sector specific engagements making it easier for businesses to respond to incidents. This included the launch of the NHS Food Safety Standard, as a result of one of the key lessons learned from the 2019 Listeria in Hospital sandwiches.

7.3 Following an incident regarding glycerol in slushed drinks in 2023, we undertook close liaison with FILG and businesses to establish guidelines for industry on use of glycerol in slushed ice drinks served to children. The approach ensured vulnerable consumers were protected from any further risk.

8. Preparedness and Resilience

8.1 The FSA has continued to strengthen its resilience and emergency preparedness by establishing the Risk Crisis Management (RCM) Programme that is building FSA capability and capacity to respond to large scale crises and non-routine incidents in response to a review commissioned by the FSA in spring 2023. The programme outcomes focus on developing a clear approach to governance, enhanced training and exercising, systematic personnel mobilisation and cohesive situational awareness and crisis communications. This will continue across 2024/25, ensuring a collective approach to incidents.

8.2 Strategic and Tactical Emergency Management training has been undertaken by the FSA executive and incident management teams to enhance FSA capacity, capability and understanding of the UK Governmental and FSA crisis management approach.

9. Forward Look

9.1 We partner with Local Authorities (LA’s) who notify us of incidents to ensure we are able to respond and where appropriate enforce regulations to ensure food and feed businesses operate within the law. In Our Food 2022: An annual review of food standards across the UK we highlighted that we are concerned that local authority food teams do not have sufficient resource to deliver food controls and respond to incidents. This was further highlighted at the December 2023 board through the Annual Local Authority Performance Review report. LA resourcing impact to incidents has been seen where LAs cannot participate in actions to track down potentially affected goods in their area or where un-registered businesses make it hard to track products across the food chain, and example being the US Grey Market goods (5.2).

9.2 IRU is working with the PATH-SAFE programme in 2024/25 to capture and implement smarter ways of working and utilise modern tools and systems to support incident activities. PATH-SAFE aims to develop a pilot national surveillance network to improve the detection and tracking of foodborne human pathogens and associated Anti-Microbial Resistance (AMR) through the agri-food system from farm-to-fork. A key output from the programme is the pilot National Foodborne Disease Genomic Data Platform, the first iteration of which was delivered in March 2024 and has been designed with Salmonella.

9.3 We will continue to enhance our preparedness for specific incidents such as Blue Tongue and continue to monitor the recent HN51 outbreak in US Cattle and be on alert for any potential spread of African Swine Fever, and any increases in outbreaks or incidents as a result of changing and developing global food systems. In readiness for this and other eventualities a primary focus of the next period will be to improve the quality of data across the agency and partners to ensure the end-to-end journey of incident management is captured as part of the agency performance framework. This will better inform what is and isn’t classified as an incident and assist with prioritisation of activity across the incident as well as looking to maximise opportunities for prevention activities, with stakeholders engaged.

10. Conclusions

10.1 We continue to see a reduction in the volumes of incidents in recent years with a further 10% fall in 23/24. Some of this will be as a result of changes in legislation and changes in consumer behaviour. Conversely, we are dealing with an increased number of complex incidents and outbreaks, which by their nature take longer to resolve. Therefore, prioritisation and risk categorising are a key operational activity to manage real-time response.

10.2 The top four hazard types for incidents remain unchanged (3.2), all showing a slight decrease in prevalence in 23/24 with the exception of a marginal increase with food additives. Pathogenic Micro Organisms remains the top hazard type of which Listeria monocytogenes was the most commonly occurring, a change to the previous years where Salmonella was the most commonly occurring cluster of interest. This is concerning due to the virulence of this pathogen with a potential risk of serious illness or death and therefore a considerable concern to public health.

10.3 The FSA continues to improve its preparedness, resilience, and capability through the RCM Programme by implementing incremental changes from lessons learnt. This is complimented by continuing to work closely with partner organisations, although Local Authority resourcing and ability to respond timeously remains a concern. We will continue to work closely with Defra and Port Health Authorities and monitor the implementation of BTOM as part of our plans for the coming year.

10.4 We will continue to work with industry to better utilise the technologies such as Whole Genome Sequencing and Root Cause Analysis to assist with incident prevention, detection and management all of which help to keep the public safe.

Annex A

Fig.1 gives an indication to the flow of information end to end across partners.

Annex B

Figure 2: Top-twelve incident notification received during 2023/24 reporting year, by incidents type.

Figure 3: Top- twelve Incident notifications received during 2023/24 reporting year, by product type.

Figure 4: Top- eight Incident notifications by notifier.

Figure 5: Number of alert notifications issued by the FSA, by reporting year.

Figure 6: Number of outbreaks by hazard. *these were the foodborne outbreaks notified to the FSA that required an operational response by the FSA, not the total number of foodborne disease, illness, or outbreak occurrences.

Figure 7: Top- twelve Incident notifications received during 2023/24 reporting year, by notifier.

Figure 8: Country of origin during 2023/24 reporting year.

Annex C

Incident Case Studies

Case study: Salmonella linked to polish poultry products

The UK has experienced an ongoing impact from Salmonella contaminated poultry meat and eggs imported from Poland since 2020. The FSA led the UK response, working collaboratively with UKHSA, DEFRA and other government departments.

In 2020/2021, FSA responded to a serious S. enteritidis outbreak, linked to imported frozen breaded chicken products from Poland. As an outcome, the UK developed a weight of evidence approach to confirm Poland was the source of the contamination and subsequent foodborne disease outbreaks. Bilateral liaison between UK officials and Poland was escalated, this involved respective Chief Veterinary Officers, (CVO’s), FSA CEO and the Secretaries of States for both the UK and Poland, and as a result Poland introduced voluntary additional measures to bring the situation under control. As a result of UK concerns, Poland introduced additional legislation. These coupled with the additional measures in the short term stabilised our concerns over UK public health impact.

A non routine incident was declared by the UK because of growing concerns over new and increased outbreaks and because the UK continued to receive a high number of RASSF notifications (over 90 since 2021). The IMCG involved relevant government departments to coordinate decisions and determine the range of escalating safeguard measure options. Escalation to non-routine incident was confirmed in IMCG in November 2023.[JJ1]

In December 2023, the FSA CEO and the UK CVO wrote jointly to the EU Commission and Polish authorities explaining our concerns and requesting that Polish authorities share with us what they are doing to resolve the issue.

We welcomed the prompt responses received from Poland and the EU regarding measures taken in the country to identify the causes of the contamination and the controls put in place to mitigate the issue, such as enhanced product testing.

In addition, FSA requested UK SPS Office to conduct an audit of Polish poultry controls, this took place in April 2024 and returned predominantly positive results demonstrative that the Polish Authorities are taking steps to manage the issue.

A detailed analysis of RASFF data revealed that the number of Polish establishments that were subject to a RASFF notification (for all Salmonella types and consignment exported to UK) has fallen, in 2021, RASFF notifications highlighted 66 establishments, in 2022 this fell to 37 and in 2023 it had fallen to 18.

The number of Polish establishments subject to 2 or more RASFF notifications has also fallen. In 2021, this accounted for 21 establishments, in 2022 it accounted for 7 establishments and in 2023, 3 establishments.

Looking at the risk decisions taken by the EU for incidents notified to the UK, regarding RASFF notifications, in 2021, 94 were categorised not serious, this fell to 71 in 2022 and 36 in 2023. Those categorised as serious, in 2021 accounted for 161 RASFF alerts, 104 in 2022 and 93 in 2023. Serious is however defined based on compliance with microbiological criteria, and the expectation of through cooking and hygienic handling by consumers, in the home. Some of the pathogens determined not serious in RASFFs, did lead to foodborne disease, for example non-regulated strains of Salmonella caused illness in the UK, albeit the species were categorised in the RASFF system as ‘not serious.’

The total tonnage of all imports of both cooked and raw poultry form Poland has steadily increased. In 2021, total imports accounted for 168 million tonnes. In 2022, this increased to 232 million tonnes, a 38% increase when compared to 2021. In 2023 this further increased to 237 million tonnes, a 41% increase when compared to 2021.

Because of the results of this analysis, the decision was taken to de-escalate in February 2024.

The FSA and UKHSA continue to monitor this issue.

Case Study: Outbreak of Shiga Toxin-Producing E. Coli linked to unpasteurized cheese

In December 2023, FSA responded to an outbreak of Shiga toxin-producing E.coli (STEC) O145, having been informed by the UKHSA that cases matched at 5 single nucleotide polymorphisms (SNPs) level by whole-genome sequencing (WGS). In WGS, the SNPs are used to estimate the relatedness between isolates, within % SNPs can be considered to be genetically related.

There were 36 confirmed cases and 1 probable case linked to this 5 SNP cluster. Public health authorities reported cases were distributed across England and Scotland, with sample dates ranging from July 2023 to December 2023, with an age range from 2 to 81 years. Concerns were raised over high hospitalisation rates, and one case sadly died.

The first joint FSA and UKHSA Cluster Assessment Team meeting was held on the 1 December 2023 which resulted in a number of subsequent Incident Management Team (IMT) meetings, led by UKHSA with support from multiple government departments, involvement from a high number of local authorities across the UK with the FSA leading the coordination of food chain analysis across the local authorities, to identify the contamination source and cause.

Epidemiological and food exposure/food chain investigations indicated an association with unpasteurised Lancashire based cheeses, with a high number of cases reported train travel on the same train operator, which had served such cheeses as part of a charcuterie board. FSA food chain analysis identified the suppliers. Subsequently, further analysis identified the manufacturer of the cheese commonly consumed by cases was Mrs Kirkhams Cheese. The food businesses acted promptly on being informed, and immediately voluntarily ceased operations whilst investigations were ongoing on the same day they were informed, and they undertook a product recall on a precautionary basis, on the advice of Preston City Council and the FSA.

The FSA amplified the message of the product recall by publishing a PRIN, on 24 December 2023, with an update PRIN’s published on 27 December 2023 & 9 February 2024, to update the product implicated, as the investigations developed. The first update was to extend the range affected, and the second update narrowed the range of products affected, after more detailed analysis had been completed, working closely with Preston City Council, the Specialist Cheese Makers Association and the Food Business directly.

Confirmation of the presence of the outbreak strain in the environment was found on the farm of origin, as a result of farm level sampling collected by the Animal and Plant Health Agency. Additional risk mitigation measures were put in place by the food business as a result on a voluntary basis, and on the advice of their trade association, working in partnership with Preston City Council. Mrs Kirkham’s Lancashire Cheese Ltd resumed production and new batches of unpasteurised cheese products were on sale as of the week beginning the 8 April. FSA continues to monitor the situation, along with UKHSA.

As part of the incident response and food chain investigations undertaken in response to this outbreak, the FSA identified a number of commonly occurring areas of non-compliance which caused food safety concern which required local authority action to improve compliance going forward. As a result, the findings have been shared with the Specialist Cheesemakers Association, with the British Retail Consortium, the Local Authorities directly affected and the wider relevant trade associations, to enable industry focus and resolution. A letter is also pending to the wider Local Authorities, to highlight these areas of non-compliance to ensure that authorities take necessary action where necessary, in order to ensure compliance with legislation and maintain food safety.

Case study: Prevention of US grey market goods on sale in UK illegally

Although this has been a problem for many years, based on the recent rise in ‘illegal grey market’ goods, the Signals Team identified and investigated growing concerns regarding illegal goods from the US with additives not permitted in the UK and on sale widely, making up 5% of annual incidents. Investigations highlighted that across LAs and ports, individual action was not effective in dealing with this systemic issue which appeared to being growing unchecked. There was an instead an urgent need for more central (FSA and FSS) co-ordinated, consistent and synchronised action with a range of approaches employed to address the issue, including focus on upstream action with importers and at ports and as well as consumer and business messaging. The work is still progressing and is the subject of an ongoing task and finish group. Referral of the issue to the RCD led cross FSA ‘Intelligence Considerations meeting’ led to some success resulting from FSA funding of enforcement actions by Staffordshire LA. The Staffordshire work was the subject of a BBC Good Morning Britain TV article in December 2023 where the depth of the problem was made clear. This resulted in broader news coverage, which raised consumer awareness in area where there previously had been none. The Chartered Trading Standards Institute issued a press release on this at the same time.

Annex D

| Example | Signal | Action |

|---|---|---|

| Example of early identification of incidents affecting the UK | A signal was detected from the United States concerning the recall of Slime Licker Sour Rolling Liquid Candies because they present a choking hazard. Signal validation identified that the products were widely available from several online retailers in the UK. | The Signals Team investigated with LAs to establish any sales and stock of the affected products in the UK. A RASFF was also identified at this stage, however the UK was not flagged. Distribution in both England and Wales was confirmed, and the Signal to be escalated to an Incident. The EU commission was contacted to ensure the UK was added to the RASFF notification. A food alert was subsequently issued for this product which mirrored the USA FBO’s recall. https://www.food.gov.uk/news-alerts/alert/fsa-prin-39-2023 |

| Example of identification of trends / emerging issues | Based on intelligence and incidents, the issue of non-legitimate branded chocolate was identified as an issue that posed food safety risks. With the run up to Christmas and with the release of the new Wonka film, pro-active comms was required to be published within a fast turnaround. Due to the pro-active, preventative nature of the comms, the Incident Prevention team were tasked at leading the comms that were to be published to Local Authorities (LAs). The team also played a key role in the corresponding consumer communications. | Messaging was conveyed to LAs across the three nations via Smarter Comms and a proactive news story was issued: https://www.food.gov.uk/news-alerts/news/fsa-warns-about-food-safety-risk-from-fake-branded-chocolate-bars |

| Example of online marketplace referrals | A signal was received from Malta concerning the unauthorised use of food colouring E110 in multiple starch-based snacks produced in the Philippines. Whilst there were related RASFFs identifying distribution to the UK of some of the products, there were several not covered which were found to be widely available online. This is just one of many signals we have received for this particular issue and is also part of the much wider issue of non-compliant grey market goods, many of which are from the USA. | The Signals Team contacted the regulator for the online marketplace, which resulted in the removal of 14 listings from sellers outside the UK. An additional 6 referrals were made for UK sellers, 1 to Food Standards Scotland and 10 to LAs resulting in the removal of these and other non-compliant products identified by the LAs/FBOs. Importers of these products have also been identified, enabling further preventative measures to be considered. One of the LAs contacted were considering carrying out targeted sampling for E110 later in the year. |

Annex E

Root Cause Analysis - Summary 2023/24

Allergen RCAs - Summary 2023/24

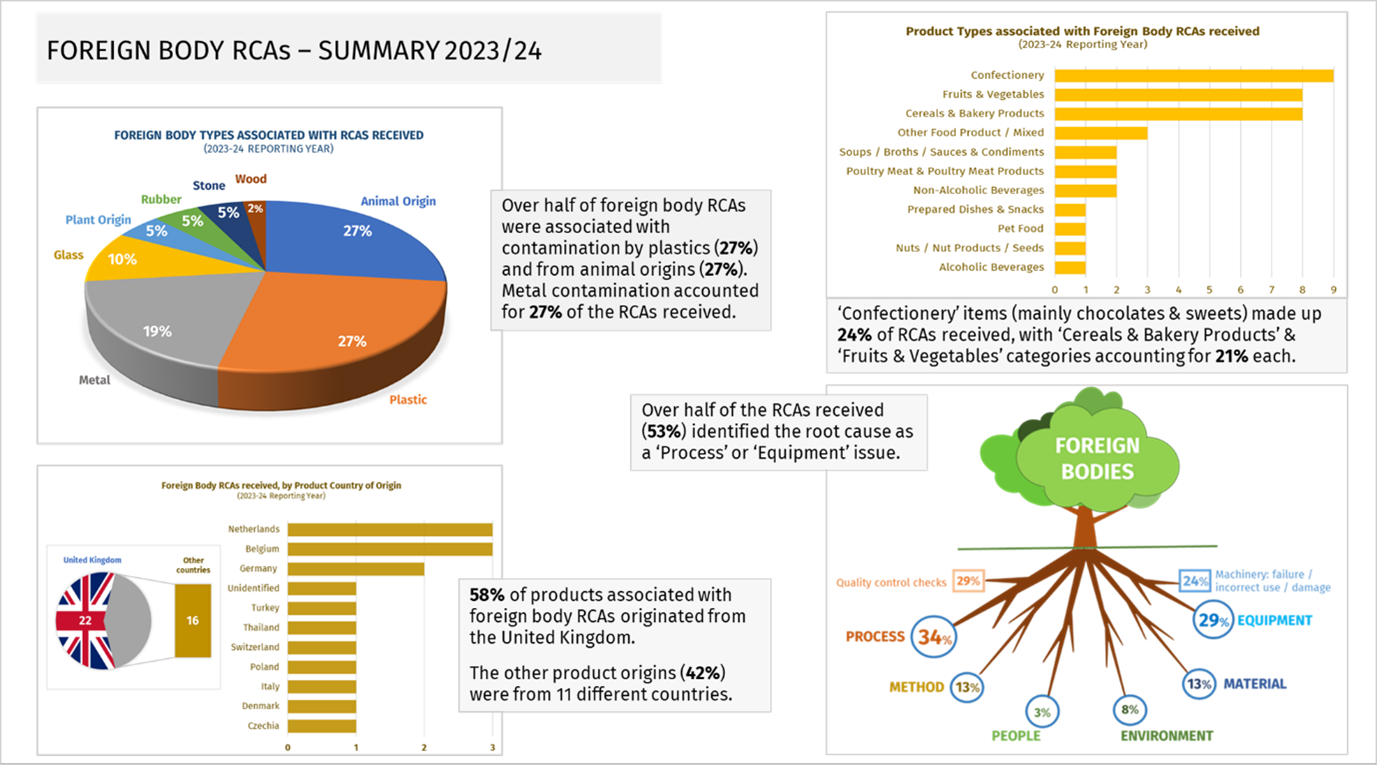

Foreign Body RCAs - Summary 2023/24

Microbiological RCAs - Summary 2023/24

Miscellaneous RCAs - Summary 2023/24

-

The FSA defines an incident as: “any event where, based on the information available, there are concerns about actual or suspected threats to the safety, quality or integrity of food and/or feed that could require intervention to protect consumers’ interests. Quality should be considered to include food standards, authenticity and composition”.

-

To note 21/22, there was a rise in Avian Influenza cases, although these cases are reported as incidents, the risk to human health is very low, subsequently avian influenza cases will no longer be recorded in incident data unless there is a potential food chain impact.

-

To which were relevant for FSA to respond.

-

As Our Food 2023 looked at January to December 2023 rather than 2023/24 FY in this report, the relative prevalence of pathogens is slightly different across the two reports.