Our Food 2022: An annual review of food standards across the UK

An annual review of food standards across the UK.

There can be little doubt that 2022 was a year of major upheaval in the UK food system For consumers, grocery prices rose faster than the rate of inflation, driving the biggest increases in our shopping bills for a generation For businesses, a combination of war in Ukraine, harvest failures, labour shortages and increased production costs added pressure to a system still managing the fall-out of the COVID-19 pandemic and adjusting to a new post-EU exit landscape.

In last year’s Our Food report, we concluded that UK food standards in 2021 had held firm despite the disruptive effects of the COVID-19 pandemic and the uncertainties presented by the end of the EU exit transition period. Yet we also acknowledged the challenges that lay ahead: a likely surge in food prices, the absence of import controls on food from the EU, and the decline in local authority resourcing. These challenges were not exclusive to 2021 – they continued to cause concern in 2022. We pick up on these themes again in our latest report as we delve into the challenges that remain beyond the height of the COVID-19 pandemic.

Every point of failure in the food chain, particularly when it relates to the authenticity and safety of what we eat, has the potential to cause harm or distress. The data in this annual report reminds us that while our food system has many strengths, it is not infallible. Maintaining the public’s trust and confidence in our food system begins with transparency and openness: that is, by being honest about how standards are changing, where they may be vulnerable, and how we need to act together to improve things for the future.

By laying out the facts and sharing all the available data and evidence we hold across our respective organisations, we hope this year’s report once again shines a light on the areas of strength and weakness in our food system. How we respond is the challenge for us as regulators as well as government, industry, enforcement authorities and consumers themselves.

Professor Susan Jebb, Chair, The Food Standards Agency

Heather Kelman, Chair, Food Standards Scotland

Introduction and scope

At a glance

This report looks at whether UK food standards improved, declined or stayed the same in 2022. It is the second year Food Standards Agency (FSA) and Food Standards Scotland (FSS) have come together to produce this annual review.

When we launched Our Food, we outlined the types of standards the report may consider, which are:

1. Food and feed safety (including allergen management) – that is, ensuring the product is safe to consume, or, in the case of feed, safe for introduction into the food chain. A number of factors are taken into account when proposing safety standards, including advice from FSA and FSS risk assessors and wider experts as well as other aspects such as the principles that may determine consumer acceptability of risk.

2. Other standards that support consumers and provide assurance – this includes provenance and authenticity, production standards (for example, animal welfare and sustainability), composition and nutritional content, labelling and advertising of food, and other information that enables consumers to make informed choices based on the values that are important to them.

To answer these questions, the report draws on a range of evidence, including local authority data, government statistics, border checks notifications, and FSA and FSS’s own sampling and surveillance activity. We explore this data from a UK-wide perspective, as well as breaking it down across the four home nations where it is meaningful to do so.

In this year’s report, we look at these issues in four ways by:

1. Examining the impact of the economic environment on consumer choice and behaviours: this includes charting the potential effect that the cost of living crisis is having on people’s ability to access a healthy and safe diet (see chapter 1).

2. Looking at how the UK food system is influenced by international factors and at the safety of imported foods: this includes the shifts in international trade patterns and the changing ways in which we manage the safety of the food we import (see chapter 2).

3. Reviewing the current landscape of business compliance: this looks at how hygiene standards have been maintained, according to the latest data, and whether enforcement authorities have the resource and capacity they need to cope with rising demands (see chapter 3).

4. Assessing available evidence on the safety and authenticity of our food itself: this draws on the intelligence gathered from FSA and FSS’s food incidents notifications data, the national food safety and authenticity surveys carried out over this period, and the work of our two national food crime units (see chapter 4).

Key findings for 2022

2022 was a deeply challenging year for consumers. Food prices rose at a faster rate than inflation for much of the year and were accompanied by sharp increases in other household expenses, adding to the strain on people’s finances. Overall spending on in-home food reduced by 6.9% in 2022 compared to 2021. Oils and spreads, dairy and alternatives, and fish, eggs, meat and other proteins experienced faster price rises than other Eatwell Guide food groups - all of them essential elements in many people’s diets. FSA and FSS focus group research showed people across a wide range of income brackets were making compromises such as swapping out premium brands for budget ranges or eating out less in a bid to cut costs.

A record number of households – one in five across England, Wales and Northern Ireland – were classified as food insecure in 2022, meaning that their diet and/or food intake had been limited in some way due to their financial or personal circumstances. Similar evidence of increased food insecurity can be seen in Scottish data. A minority of people across the UK also reported cutting corners on food preparation and hygiene, including reducing their use of fridges and freezers or reducing the length of time they cooked their food, to reduce energy bills.

The global food system had to adapt to abrupt shifts in trading patterns as traditional supply lines were disrupted for some commodities. Though the available data from border checks does not indicate any shift in the safety of goods arriving from outside the EU, the UK has increased the number of high-risk foods now subject to enhanced checks at the border, partly in response to concerns about pesticide residues and other toxins in products from certain countries. As EU imports are not currently checked, we cannot comment authoritatively on the safety of goods arriving from the EU.

As we develop new trading partnerships, FSA and FSS will continue to advise government on whether new free trade agreements (FTAs) uphold statutory food safety protections. To support the public’s interest in understanding the wider production values of imported food, FSA and FSS are also exploring how to address the lack of robust, international data on issues such as animal welfare and environmental and ethical production standards.

Although food businesses have also experienced sharp rises in their costs, the latest inspection data suggests this has not translated into any detectable reduction in compliance with food hygiene standards. Based on the latest inspection data as at the end of 2022, the vast majority of food businesses had met food hygiene standards at the point when they were last inspected.

Meanwhile the number of local authority inspections carried out returned to pre-COVID-19 pandemic levels in 2022. This is an important milestone, but it should be noted there were still approximately 39,500 unrated businesses at the end of 2022 across England, Wales and Northern Ireland. Adequate resourcing is vital for ensuring food hygiene rules are upheld, but the FSA’s analysis of local authority staffing shows there are approximately 14% fewer food safety posts being funded across England, Wales and Northern Ireland compared to a decade ago – and even where these posts do exist, over 13% are vacant.

The situation in Scotland is more pronounced, where there are 25% fewer food safety posts than in 2016. There have also been reductions in food standards and food law officer posts across the UK, further challenging the ability of local authorities to carry out essential checks on food authenticity, composition and information standards. In 2022, both FSA and FSS had to take additional measures to address the ongoing resourcing challenges being faced by the veterinary profession – particularly in the recruitment of Official Veterinarians (OVs).

Analysis of reported food incidents and foodborne disease outbreaks, the results of national sampling programmes delivered by FSA, FSS and Defra, and the available intelligence on food crime do not suggest there has been any significant change in food safety and authenticity standards during 2022. However, we are concerned about ongoing breaches in food composition labelling in relation to allergens. To address this, further collaboration with local authorities and food businesses will be required.

Detailed chapter-by-chapter outline

This year’s report is made up of four chapters, each focusing on a different factor affecting our food system in 2022 We have listed the key points from each of these below.

The nation's plate

Our first chapter explores whether food price inflation and other cost of living pressures may have affected consumer choice and behaviour. While it is not yet possible to provide detailed analysis of actual changes in our dietary intake during this period, we look at what the economic data reveals about the impact of inflation on different food types and what FSA and FSS consumer research tell us about the public’s attitudes and perceptions of how financial pressure is affecting their relationship with food.

1. Food price inflation made a substantial contribution to the cost of living pressures affecting UK households. Data from the Office for National Statistics (ONS) shows food price rises averaged out at 11% over the course of 2022, with a year-on-year rise of 17% by the end of December 2022. This represents the biggest rise in the cost of our food since 1977. While every part of our shopping basket has been affected, our analysis of products in the Eatwell Guide categories shows that certain food types – including oils and spreads, dairy and alternatives, and fish, eggs, meat and other proteins – felt the sharpest rises. Foods high in fat, sugar and salt, as well as fruit and vegetables, experienced a lower rate of inflation than others.

2. Meanwhile the overall amount that consumers spent on food fell for the first time in a decade. The £8 billion (or 6.9%) reduction in our inhome food spend reported in 2022 compared to 2021 may partly reflect the increased spending during the pandemic, but it is also likely to be due to the strain on household food budgets caused by wider cost of living pressures. This is supported by evidence from FSA and FSS focus groups which reported that many people across a range of income brackets said they had been swapping out premium brands for cheaper alternatives or using budget retailers. Others also reported cutting down on perceived ‘luxury’ items like fresh meat and other fresh produce.

3. Food prices became the number one food issue of concern for UK consumers in 2022, according to FSA and FSS research. During the course of the year, around 41% of adults questioned in Scotland said they were worried about affording food compared to 25% in 2021 - while in England, Wales and Northern Ireland, the rate of public concern about food prices increased from 22% in 2021 to 34% in 2022.

4. One in five households (20%) in England, Wales and Northern Ireland were classified as food insecure in 2022 according to FSA research – the highest rate recorded since it began tracking in 2016. 10% of households were classified as having low food security, which means they reported eating reduced quality, variety or desirability of diet, but with little or no indication of reducing their food intake. A further 10% were classified as having very low food security, reporting multiple indications of disrupted eating patterns and reduced food intake. There was also an increase in the number of adults skipping meals and reducing portion sizes to save money across the UK. There is also evidence that some consumers have altered the way they store and cook their food in an effort to reduce costs.

Going global

This chapter describes where we are sourcing our food from by examining how the pattern of food imports changed during 2022. It looks at the latest available evidence from border checks and other safety notifications to examine whether the safety of imported food is being maintained. We also look ahead at the impact of new FTAs on our food system, and how we collectively build a more authoritative way of tracking and measuring imported food standards for the future.

1. Analysis of trade data shows there was a 5.6% increase in the volume of food imports into the UK compared to 2021 as global markets returned to normal after the COVID-19 pandemic. The amount of food the UK buys from other countries is now in line with the average seen over the past decade. There has been little change in the top 10 countries we source most food from, but greater volatility further down the list. There has been a notable drop in imports from Ukraine, Russia and certain Baltic countries and a sharp rise in imports from some South Eastern European countries, particularly Romania and Bulgaria.

2. Available data on compliance checks carried out at the border is restricted to imports from non-EU countries due to the continued absence of EU import controls. Data shows that there have been no significant changes in compliance failure rates in recent years. However, the UK now has responsibility for defining its own list of high-risk foods which are subject to more stringent controls, and has decided to increase checks on certain products in response to risks associated with pesticide use, contamination with mycotoxins and the rise in the presence of Salmonella in some parts of the world.

3. The UK has signed FTAs with Australia and New Zealand during 2022. FSA and FSS provided advice to the Government as part of Section 42 of the Agriculture Act 2020. In our response, we concluded that these agreements with Australia and New Zealand upheld statutory food safety protections for the consumer. For the New Zealand agreement, we also assessed whether it maintained statutory protections for nutrition and concluded that it did.

4. The FSA commissioned an expert report from the consultancy ADAS, looking at how it might identify and gather better information on imported food production standards. Although this underlined the lack of available data, we will continue to explore how it can meet the public’s interest in this information, working in partnership with government and industry.

Keeping it clean

This chapter reviews the latest available data on food hygiene standards across a range of food and feed businesses. It looks at whether there have been any changes in food hygiene ratings for restaurants, cafés and other places that serve food, as well as the level of compliance in dairy, meat and animal feed establishments. In the wake of the COVID-19 pandemic, it also explores how effectively enforcement authorities have managed to restart their system of official controls and whether they have sufficient skilled resource and capacity to meet demand.

1. Data from the two national food hygiene rating schemes – the Food Hygiene Information Scheme (FHIS) and the Food Hygiene Rating Scheme (FHRS) – shows that the vast majority of food businesses had satisfactory or better hygiene standards based on inspection data as of 31 December 2022. Just over three-quarters (75.7%) of food businesses in England, Wales and Northern Ireland achieved a top rating of 5 for hygiene, while 2.9% of food establishments achieved a rating of 2 or below meaning they require improvement, major improvement, or urgent improvement. Across the whole of the UK, these figures show little or no change compared to the previous year.

2. Similarly, the available data on hygiene compliance in dairy establishments shows the vast majority in England, Wales and Northern Ireland continued to operate safely: 98.1% of farms and establishments in England and Wales, and 99.1% in Northern Ireland achieved satisfactory or good compliance levels. In Scotland, there is some evidence of the re-establishment of hygiene controls after the COVID-19 pandemic, with an increase in the number of inspections, guidance letters and instances of written advice being issued in 2021/22. No Hygiene Improvement Notices (HINs) were issued between April 2018 and March 2022.

3. Analysis of workforce data over the last decade shows that the number of food safety allocated posts[1] supported by local authorities in England, Wales and Northern Ireland has fallen by nearly 14% since 2011/12. Resourcing issues have been compounded by challenges in filling these roles, with approximately one in seven (13.7%) vacant. In Scotland, the shortage is more severe as the number of occupied food law posts fell by just over 25% compared to 2016/2017.

4. These reductions in local authority staffing also extend beyond food hygiene. There has been a 45.1% drop in the number of food standards officer allocated posts from 2011/12 to 2021/22 in England, Wales and Northern Ireland. A survey published in 2020[2] found that trading standards officer staffing levels fell between 30% and 50% across the UK between 2008/9 and 2018/19. It also found that just over half of the local authorities in the UK did not believe they had sufficient expertise to cover the full range of trading standards responsibilities, and that the ageing trading standards workforce was a threat to future professional capacity.

5. As the whole veterinary profession continues to face challenges in capacity, both FSA and FSS have felt the ongoing effects in the recruitment of OVs who oversee inspections in meat establishments – with a reported 27.4% fewer people joining the profession between 2019 and 2022 (RCVS, 2022), a notable increase in vets leaving the UK-practising category (RCVS, 2021) and a reluctance from veterinarians graduating from UK universities to take on public health roles. Recruitment from overseas remains an essential route, and this is supported through the option of Royal College of Veterinary Surgeons (RCVS) Temporary Registration. Both agencies are working to reduce reliance on temporary registration schemes as quickly as possible.

Safe and sound

The final chapter brings together data and intelligence collected by FSA and FSS to assess the safety and authenticity of the food we buy. It includes analysis of the food incidents data and foodborne disease outbreaks, the national food sampling surveys conducted across the UK, and the patterns of criminal investigations and ‘disruptions’ led by our two national food crime units to tackle fraud, adulteration and other types of criminal behaviour within the food chain

1. The total number of reported food incidents across the UK decreased slightly in 2022 compared to 2021 but remained broadly consistent with long-term trends. Meat and meat products continued to be the food category most often associated with food incidents. The leading cause of food incidents was pathogenic microorganisms, accounting for 29% of all UK cases. The number of incidents relating to undeclared or incorrectly declared allergens has returned to preCOVID-19 pandemic levels, following a decline in cases during 2020 and 2021.

2. The rate of most foodborne diseases reverted to pre-pandemic levels during 2022. However, reported cases of Shiga toxin-producing Escherichia coli O157:H7 (also known as STEC O157) reached their highest level since 2015, largely as a result of a major outbreak that was detected in the summer of 2022. The routine use of whole genome sequencing (WGS) is now helping public health authorities to identify more clusters of foodborne disease and has allowed the UK’s food safety and public health authorities to play a leading role in detecting domestic and global outbreaks.

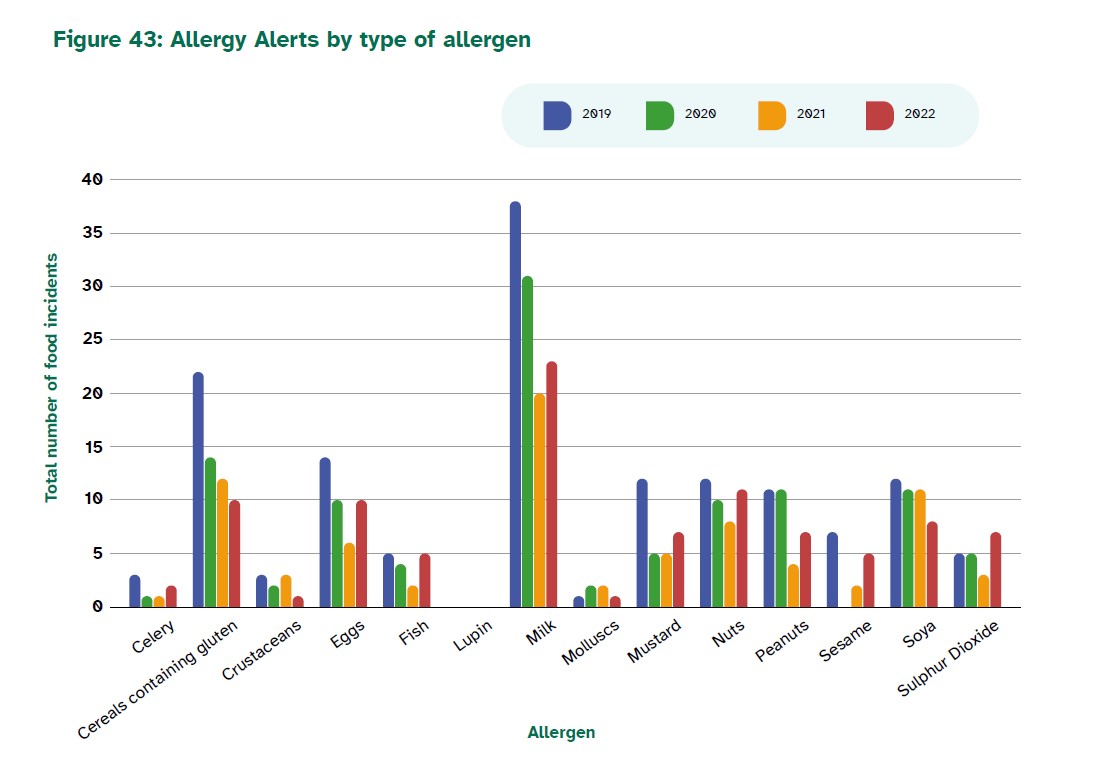

3. There was no overall change in the combined number of Allergy Alerts issued by the UK’s food agencies in 2022 compared to the previous year. The reported increase (of 25%) in the number of Product Recall Information Notices (PRINs) is largely due to changes in how these figures have been collated this year, rather than any increase in overall number of notices being issued. Neither FSA nor FSS were required to issue a Food Alert for Action (FAFA) notice – the most serious category of food incident alert – in 2022.

4. FSA and FSS’s national sampling programmes play an important role in tracking areas of risk and vulnerability in our food system. The FSA’s targeted survey 2022 showed no statistical difference in the level of non-compliant results from previous years. Around a third of the failures in testing related to labelling breaches. The findings also revealed further potential public safety issues relating to allergen declarations, reinforcing the continued need for regular checks by local authorities and businesses.

5. Sampling of oat and oat-based products within FSS’s sampling programme did not detect unsafe toxins or heavy metals. However, there were instances of undeclared allergens in the free-from products tested, and a significant proportion (18%) of minced beef samples either had a higher fat content or a lower meat content than was declared on the packet. It should be emphasised that FSA and FSS surveys are targeted at areas of known risk and therefore carry a greater likelihood of identifying unsatisfactory results. They should not be seen as representative of overall UK food standards.

6. The two national food crime units carried out a range of investigations throughout 2022 in line with their respective strategies. In England, Wales and Northern Ireland, the National Food Crime Unit (NFCU) has been heavily focused on tackling threats in the red meat sector, the diversion of animal by products into the food chain, and pursuing suppliers of dangerous non-foods sold for consumption. In Scotland, the Scottish Food Crime and Incident Unit’s (SFCIU) investigations under common law included a focus on suspected fraud in relation to counterfeit alcohol as well as traceability and adulteration in the meat supply chain and illegal slaughter.

7. Both the NFCU and SFCIU work closely with industry, local authorities and other enforcement agencies on other activities designed to disrupt or deter criminal behaviours. In England, Wales and Northern Ireland, a sizeable amount of the NFCU’s disruptions included action against dangerous non-foods through the removal of the illegal dieting drug 2,4-Dinitrophenol (DNP) from online sale, as well as ongoing action against criminality in the red meat sector and the diversion of animal by-products into the food chain. In Scotland, a significant number of SFCIU-led disruptions similarly centred on criminality affecting meat and meat products. It also tackled fraud involving Scottish grown tea, confectionary and honey and made a series of unannounced visits with partners to pubs and other licensed venues to check for counterfeit products and deter any future criminal behaviour.

8. Both food crime units are closely monitoring the impact of price inflation, the legacy of the COVID-19 pandemic, environmental changes and the ongoing Ukraine conflict on criminal behaviour. No evidence was detected in food surveillance or sampling activity, or in the data made available via the Food Industry Intelligence Network (FIIN), to suggest there has been any increase in authenticity issues attributable to criminals responding to these big picture issues. However, it is recognised that the current economic conditions may present further opportunities for criminality within the food chain.

Setting this year's report in context

Just as it began to recover from the upheavals of the COVID-19 pandemic, our food system was hit with a further set of challenges in 2022. Rising prices, extreme weather, labour shortages, post-EU exit changes to UK trading relationships and border controls, and the war in Ukraine all created volatility and change, playing an important role in the story of our food in 2022.

Households in the UK faced increased prices across a wide range of goods and services, while incomes failed to keep up with the pace of increasing inflation. Between 2021 and 2022, electricity, gas and other fuel prices increased by 4%, house contents insurance by 23%, and operation of personal transport by 15%, summarised in figure 1.

Data from the ONS shows that food price rises averaged out at 11% over the course of 2022, with a year-on-year rise of 17% being reported by the end of December 2022. This represents the biggest rise in the cost of our food since 1977. As figure 2 shows, for the first half of the year, consumers experienced food inflation pressures similar to the overall rate of inflation, but the second half of the year saw food inflation rising much faster.

Figure 1: Percentage change over 12 months of inflation by commodity type

Source: Consumer price inflation tables - Office for National Statistics

Some of the drivers of food price inflation are summarised in figure 1 – yet the extent to which individual foods have been affected by these issues varies considerably, which helps to explain why some products experienced much sharper rises than others, as we will see in chapter 1.

For example, according to the Agriculture and Horticulture Development Board (footnote 1) (AHDB), milk prices have been sharply impacted by increases in farmer input costs and threats of milk shortages. The steep rises in margarine prices are likely to have been caused by a shortage of sunflower oil (due to the conflict in Ukraine), increased market demands (driven by increases in butter prices as a result of milk shortages), export restrictions on vegetable oils, bad weather conditions and increased demand by industry for biofuels as crude oil prices increased.

Egg producers, meanwhile, have suffered as a result of rising energy prices and costs of chicken feed, as well as an outbreak of avian influenza, which led to an egg shortage as some UK farmers were forced to cut production. Furthermore, 70% of the eggs we buy in the UK are free-range, but with only 13% of eggs in the EU produced in this way, the option to fill the gaps on UK supermarket shelves with imports was limited (footnote 2), driving the price up.

Figure 2: Percentage change over 12 months (2022) - Food inflation rates vs overall Consumer Prices Index including owner occupiers’ housing costs (CPIH)

Source: Consumer price inflation tables - Office for National Statistics

An important theme running through this report is the Russian invasion of Ukraine, which contributed to big rises in energy costs in early 2022 and affected global access to vital commodities such as grain, cereals and cooking oils as military action prevented crops from being harvested while Black Sea blockades in the spring and summer of 2022 impeded international shipping routes. This has intensified the rises in production costs felt by UK businesses and contributed to some shifts in where we source our food from, as we discuss later in chapter 2 of this report.

Last year also saw several important milestones in the development of the UK’s post-EU trading relationships, including the signing of FTAs with Australia and New Zealand, and the introduction of new pre-notification requirements for high-risk EU food and feed. However, there have been further delays in the introduction of import controls for EU food and feed, with the new Border Target Operating Model now due to take effect in 2024. The UK’s departure from the EU has also had a material impact on the recruitment of key professionals involved in supporting food safety controls, including the supply of OVs (see p76).

Finally, although the last COVID-19 pandemic restrictions were lifted in February 2022, the disruptive effects of the pandemic continued to affect the food system throughout the year, not least in the resourcing and management of food hygiene controls. The efforts of local authorities and other food enforcement authorities in recovering the ground lost during the pandemic are documented in chapter 3 and reinforce the need to ensure adequate resourcing is in place to maintain effective consumer protections.

An overview of key factors influencing food prices in 2022

A range of factors have contributed to the changes in the cost and availability of our food, many of them associated with the war in Ukraine, the UK’s departure from the EU, and the knock-on effects of the COVID-19 pandemic. These include:

Adverse weather

The UK experienced one of the hottest and driest summers on record in 2022, severely impacting domestic crop yields. The intense heat also affected harvests in parts of Europe, pushing up the cost of olive oil, vegetables such as cucumbers and parsnips, and some soft fruits.

Energy and transportation costs

Like UK households, food producers also experienced surges in their energy and fuel bills, making it more expensive to produce and transport food. As with the increases in other commodity prices, these costs were passed onto the consumer through higher prices.

Commodity prices

The price of key commodities for the food industry also rose steadily, adding to producers’ costs. This included sharp increases in the cost of fertiliser, rapeseed and sunflower oil, and cereals such as wheat and maize – many of which were directly affected by Russian blockades of Ukrainian ports.

Labour shortages

The food industry has also been hit by labour shortages. UK farmers, for instance, faced a chronic shortage of seasonal workers during the summer of 2022, as nearly two thirds of all seasonal visas had previously been issued to Ukrainian workers.

Consumers and food standards

At a glance

In this chapter, we look at:

- how inflation has affected the cost and affordability of different foods

- how food choices, priorities and behaviours have changed

- what impact this is having on our ability to access a healthy diet

Introduction

2022 was a tough year for consumers UK food and drink prices rose at the fastest rate since 1977, wages fell in real terms, and there were steep rises in fuel and energy prices, and the cost of borrowing, all of which compounded the financial pressure on households.

But what difference did this make to people’s behaviours and thoughts about food? Can we detect any changes in what we eat, how we cook and how we shop? This chapter explores what we know so far about the impact of cost of living pressures on our ability to access a healthy and safe diet.

The impact on the consumer

Food inflation affects different people in different ways. Although the media and other commentators often use headline inflation figures to describe the rate at which food prices are rising, these are calculated by looking at the average changes in price across a selection of typical items from our shopping baskets.

However, the extent to which someone is personally affected by inflation – and how that may in turn influence what they eat – depends on the foods they buy and how much those items’ prices have changed. So, before we look at our dietary choices, it is useful to look at how price rises vary across different food categories to give us a more nuanced picture of the impact on consumers.

For this report, we have chosen to build our analysis around a selection of commonly bought items, which we have broken down by Eatwell Guide categories (figure 3). This shows that three food categories experienced the sharpest rises in price when averaged out over the course of the year:

- oils and spreads

- dairy products such as milk, yoghurt and cheese, as well as non-dairy alternatives

- fish, eggs, meat and other proteins (footnote 1)

The breakdown also shows that foods high in fat, salt and sugars experienced the lowest rate of inflation (8%), closely followed by fruit and vegetables (9%).

Figure 3: Average percentage 12-month year on year increase in costs during 2022 for Eatwell guide categories

Source: ONS Consumer Prices Index including owner occupiers' housing costs (CPIH) January 2022 to December 2022.

Of course, analysing these differences only gives us part of the story. Our ability to adapt to any increases in price will also depend on how cheap or expensive something is to begin with, and how much and how often we eat it. Price rises in staples such as pasta, eggs, milk and bread, are likely to be felt more keenly by households than luxury or occasional items.

From a healthy eating perspective, it is also important to consider the amount of products within each category a person needs to consume as part of a balanced diet: hence, although we can see that fruit and vegetables experienced lower inflation than other categories, consumers would need to buy a lot more of them if they want to meet government healthy eating guidelines.

All of this needs to be understood in the context of an individual’s wider financial position: in cases where people’s household budgets are already precariously balanced, as we will see, the personal impact of these differing inflationary effects can be especially harsh.

How much are we spending on our food?

A sign of how difficult things became for households can be seen when we look at how much people spent on food overall in 2022. With food prices going up sharply, it would be natural to assume that we would see people spending more on food. In fact, we saw the opposite. Increased financial pressure in areas where people have less control over what they spend (such as housing or energy costs) means that spending on in-home food fell in 2022, even though total household expenditure itself increased (footnote 2).

In 2021, out of a total household spend of £1,276 billion, the UK spent 9.5% (£120 billion) on in-home food and non-alcoholic drinks and 1.9% (£24 billion) on alcoholic drinks. In 2022 we spent over £8 billion less (a total of £112 billion) on in-home food and non-alcoholic drinks and £2 billion less on alcoholic drinks (a total of £22 billion) compared to the previous year, a respective drop of nearly 6.9% and 9.6% (footnote 3).

The percentage of disposable income spent on food outside the home (restaurants and café meals, takeaways, contract catering, and canteens) in 2022 was higher than in 2021 but 37% below pre-pandemic levels (2019) across all income groups. While 2021 showed an unusually large dip in spending on food outside the home, which has slightly recovered for 2022, the overall trend is in line with consumers changing their spending habits due to the increased cost-of living[6].

This is the first time in a decade we have seen a year-on-year reduction in in-home spend on food and drink. Although in-home expenditure on food rose particularly sharply in 2021, likely due to the unique conditions we experienced during the COVID-19 pandemic, we are now seeing a levelling off to pre-pandemic levels.

There are some stark dividing lines between different income groups. When we look at how much of people’s disposable income was spent on in-home food (figure 4), we find that lower-income households now spent more than 16% of their weekly budget on in-home food. By comparison, the highest-income households spent just 5% of their weekly budget on in-home food.

An indication of how this may be affecting some people’s ability to access healthy food is found in the Food Foundation’s 2023 Broken Plate Report. According to its analysis, which covers 2021 to 2022, the poorest fifth of UK households would need to spend 50% of their disposable income on food to meet the cost of the Government’s recommended healthy diet, whereas the richest fifth would only need to spend 11%.

Figure 4: Percentage of disposable household income spent on in-home food by income deciles in financial years 2020 to 2022

*Each decile represents one tenth (10%) of UK households. The information for the lowest (or first) decile is collected differently from the rest and represents the 20% of UK households with the lowest income. The highest decile represents the 10% of UK households with the highest income.

This compares to 43% for the poorest fifth and 10% for the richest fifth reported a year earlier in the 2022 report, suggesting that it has become harder for the most deprived households to afford a healthy diet. The latest report also suggests that healthier foods are over twice as expensive per calorie than less healthy foods, which makes it even more challenging to purchase and consume a healthy diet.

If we factor in the additional price inflation seen last year, it is reasonable to conclude that pursuing a healthy diet is now likely to require an even higher proportion of disposable budget for low-income households. With other non-discretionary costs also rising, this is likely to be contributing to a widening of dietary inequalities, which may impact on the already significant pressures on the NHS.

How did price rises affect our priorities and behaviours?

Understandably, the financial environment strongly influenced people’s mindset and attitudes to food in 2022.

When asked about a range of food-related issues, food prices rose to become the number one food issue of concern for consumers across England, Wales and Northern Ireland (footnote 4) (figure 5). For these parts of the UK, this is the first time food prices have been the most commonly-reported concern since tracking began in 2020, surpassing other issues such as food waste, animal welfare and the amount of fat, sugar or salt in food. In Scotland, food prices also became the number one concern for consumers in December 2021 and remained at the top throughout 2022 (footnote 5) (figure 6).

Figure 5: The top reported food concerns for consumers in England, Wales and Northern Ireland

Source: FSA Food and You 2 survey - Wave 3 (conducted April to June 2021) and Wave 5 (conducted April to July 2022).

Figure 6: The top reported food concerns for consumers in Scotland

Source: Food in Scotland Consumer Tracker - Wave 13 (conducted December 2021) and Wave 15 (conducted December 2022).

As general concerns about food prices increased, so too did people’s anxieties about affordability of food. In England, Wales and Northern Ireland, worries about being able to afford food rose to a peak of 40% in September 2022, before dropping slightly during the autumn and winter. Although differences in how the data is collected make it difficult to make a direct comparison, the data for Scotland shows a similar picture: again, around 40% of adults reported that they were worried about being able to afford enough food in December 2022.

These financial concerns appear to have affected how people shopped and ate. Many consumers reported swapping out preferred brands for cheaper alternatives, changing the type of foods they ate, eating out less, and ordering fewer takeaway meals. In the FSA’s Food and You 2 survey, those who reported making changes to their eating habits in the last 12 months were asked the reason or reasons for making these changes. The most common answer was financial (69%) followed by health concerns (47%). In Scotland, two-thirds (67%) of those who said they had worried about affording food over the previous 12 months said they had eaten out less often while 5% said they had fewer takeaways.

Food swapping behaviours

England, Wales and Northern Ireland - Around a third of respondents reported changing the food they bought (34%) or where they bought food from (33%) to cheaper alternatives in the last 12 months (April-July 2022).

Scotland - Almost half of respondents (46%) reported swapping brands for cheaper alternatives more often and 37% had bought reduced to clear food items more often in the last six months (December 2022).

Cutting down on takeaways and eating out

England, Wales and Northern Ireland - 47% of respondents reported eating out less, and 41% reported eating fewer takeaways in the last 12 months when surveyed between April and July 2022 (Food and You 2, Wave 5).

Scotland - Over half of respondents (56%) in Scotland reported eating out less and 50% reported eating fewer takeaways in the six months leading to December 2022 (Food in Scotland, Wave 15).

Similarly, in-depth focus group research conducted by FSA and FSS in late 2021 and early 2022 explored the lived experiences of UK consumers, showing the changes that many were forced to make as their budgets became more stretched.

The research reveals that the impact of cost of living pressures was not confined to the lowest income groups: it found that across different income brackets, people were swapping out premium brands for cheaper alternatives or using budget retailers instead of their regular supermarket.

People also perceived higher-quality food as more expensive and felt that buying cheaper foods meant they had to make compromises on food quality, health and nutrition.

Yet other research suggests that the prices of cheaper own brand and budget ranges went up faster than the branded ranges. Analysis by the consumer watchdog Which? shows that throughout 2022 own-label budget and own-label branded foods went up by over 18% compared to 13% for branded goods. While the baseline price of many of these ranges is cheaper than the premium brand, the increase is likely to have hit the most financially vulnerable groups hardest.

As I’ve gotten older, I really have noticed how horrible cheaper food is I wish that they would sell food that is accessible to everybody so that poor people could eat things like salmon for example there’s no doubt about it in the long run, you eat cheap stuff, you get ill.

I try to purchase products which are on offer or multi-buy deals This allows me to buy higher-quality food for a lower price… This is how I wish things would change - deals and offers were on more healthy foods than junk foods.

FSA and FSS’s own qualitative research supports this: it shows that for some households every penny used to buy food is carefully budgeted, and a relatively small increase within a food budget that is already under huge pressure represents a major issue.

If it’s something that’s a wee bit more expensive, I would indulge, to have the quality of it Then I’m willing to pay the price for the quality, but I think I’m getting to the stage in the current climate where the quality’s not coming with the price You know, the lower items are coming with high-quality price tags, but high-quality’s not being delivered.

Food insecurity

What does this all mean in practice? One of the most important measures showing how all of this has affected people’s diet and food choices is the proportion of households now defined as being food insecure.

The FSA’s Food and You 2 research uses the United States Department of Agriculture (USDA) measure of adult food security:

- high food security means there are no reported indications of food-access problems or limitations.

- marginal food security means there are one or two reported indications – typically of anxiety over food sufficiency or shortage of food in the house, and little or no indication of changes in diets or food intake.

- low food security means there are reports of reduced quality, variety, or desirability of diet, but little or no indication of reduced food intake.

- very low food security means there are reports of multiple indications of disrupted eating patterns and reduced food intake. Those with high or marginal food security are referred to as “food secure”.

Those with low or very low food security are referred to as “food insecure”.

In the FSA’s survey conducted between April and July 2022, it was found that:

- one in five (20%) households across England, Wales and Northern Ireland were defined as food insecure, with around half of these (or one in ten households overall) classified as having very low food security.

- 13% of households were shown to have marginal food security.

This is the highest level of reported household food insecurity since tracking began in 2016 (footnote 7).

Food security exists when all people, at all times, have physical and economic access to sufficient, safe and nutritious food that meets their dietary needs and food preferences for an active and healthy life

The evidence also shows that some groups are more at risk of food insecurity than others (figure 7). For example, in England, Wales and Northern Ireland those with a long-term health condition are nearly twice as likely to be food insecure than those without a long-term health condition.

Other groups that are more likely to report food insecurity include younger adults, households with children under 16, and unemployed or low income households. People with food allergies are also more likely to report food insecurity, and recent FSA research indicates that adults with a food allergy spend more on food on average compared to those without a food allergy.

And there is significant regional variation too: 25% of those in the north-west of England and 25% of those in Yorkshire and the Humber are food insecure compared to 13% of those in the south-east and 15% of those in the south-west of England.

Figure 7: Who is most vulnerable to food insecurity?

Source: FSA Food and You 2 survey - Wave 5 (conducted April to July 2022)

To give us a sense of the impact this has on people’s lives, the FSA’s monthly tracking data shows that the proportion of adults skipping meals or cutting the size of meals because they did not have enough money to buy food rose during much of 2022 (figure 8). On average, 26% of people did so in 2022, compared to 20% in 2021 (footnote 8). In Scotland, 22% of adults skipped a meal due to lack of money in 2022, compared to 20% in 2021.

Figure 8: Proportion of respondents reporting they have cut down on portion size/ skipped meals due to money [FSA figures for England, Wales & Northern Ireland]

*An ‘*’ is used to indicate months with a statistically significant difference to the previous month.

Source: FSA Consumer Insights Tracker (March 2022 to March 2023)

The impact on the population's health and diet

As last year’s report made clear, for decades our diets have contained too much salt and saturated fat, too many free sugars (footnote 9) and not enough oily fish, fruit and vegetables, and fibre. These findings are also reflected in the most recent Scottish Health Survey for 2021 (figure 9).

Figure 9: Key findings from the Scottish Health Survey 2021

Source: Scottish Health Survey 2021

It is too soon to say what the impact of cost of living pressures will be on people’s dietary choices, not least because we do not have the latest data from the National Diet and Nutrition Survey, the most comprehensive data source on the types and quantities of food consumed in the UK as a whole.

What we do know from research conducted in early 2022 is that most people (70%) feel confident that they know what a healthy nutritious diet is. This was typically associated with fresh, minimally-processed food that offers a good variety of nutrients. These included fruit and vegetables, traditional staples such as milk and bread, and good quality meat. In contrast, unhealthy foods were often perceived to be more processed, higher in additives, and higher in saturated fat, sugar and salt. People may be feeling that it is increasingly hard to achieve a healthy diet in the current economic environment.

When asked about their concerns for the future of food over the next three years approximately two-thirds (68%) of participants said they were concerned about the cost of healthy food (footnote 10), 53% felt priced out of healthy foods (footnote 11) and 31% said that they find it difficult to find fresh food that fits within their budget (for example, fruit, vegetables, meat) (footnote 12).

Concerns about the ability to access healthy food were most commonly expressed by people in lower socio-economic groups, those with lower incomes, people living with food insecurity, ethnic minority groups, larger households, younger families and younger adults (aged 18-44) without children who are living alone or with a partner.

Healthy to me is eating fruit and vegetables along with fresh cooked wholesome dinners on a daily basis.

I worry about the affordability of buying food - with inflation and no pay rises for workers Not being able to feed my family properly Having to rely on rubbish unhealthy food which could compromise our health

To what extent are these concerns influencing what goes in people’s shopping baskets? ONS purchasing data for 2022 shows that although we spent less on in-home food than in previous years, the reduction in spending was spread relatively evenly across meat, fruit and vegetables and sugary goods, suggesting that there has not been any notable difference in the way we divide our spending between different food categories.

What about the perceived “quality” of the food we are purchasing? We have already shown evidence that consumers are switching to cheaper alternatives such as own brand or value range products, reducing portion size/quantity or reducing spend on premium produce in favour of household staples. However, while this might feel like a drop in the perceived quality – or desirability – of people’s food, what we do not know yet is whether all of the above has had any impact on the actual nutritional value of what people eat.

Food safety and cost of living pressures

One final consequence of the financial pressures experienced during 2022 relates to how people store and cook their food. The FSA started monitoring consumers’ food storage and cooking behaviours on a monthly basis from September 2022 (see figure 10). FSS asked consumers a similar question in December 2022, asking respondents to consider the previous six months (figure 11).

Some of these behaviours involved using different cooking methods – for instance, in September 2022 around six in ten people (59%) in England, Wales and Northern Ireland reported using cheaper cooking methods (such as air fryers, microwaves, or slow cookers) instead of ovens to heat food as a way of saving money. In Scotland, 45% reported switching cooking methods over the six months up to December 2022.

However, a smaller proportion of people reported behaviours that could put them at greater risk of food poisoning, including reducing the length of time food was cooked for, lowering the cooking temperature for food, changing the setting of their fridge or freezer, or even switching these appliances off altogether to reduce electricity costs.

We also found some evidence that consumers were eating food past its use by date: this peaked when a third of consumers in England, Wales and Northern Ireland reported doing this in October 2022 (figure 12).

In England, Wales and Northern Ireland, all of these behaviours declined in November 2022, coinciding with the introduction of the Energy Bills Support Scheme, and the November Cost of Living payment (to eligible households). Although we cannot prove causation, it is possible that these schemes contributed to this observed decrease.

Figure 10: Change to consumers’ food storage and cooking practices in England, Wales and Northern Ireland

*An ‘*’ is used to indicate months with a statistically significant difference to the previous month.

Source: FSA Consumer Insights Tracker (September 2022 to March 2023)

Figure 11: Things people have done in Scotland to save money in the last 6 months

Source: Food in Scotland Consumer Tracker, Wave 15, December 2022

Figure 12: Further changes made by consumers in England, Wales and Northern Ireland to save money

*An ‘*’ is used to indicate months with a statistically significant difference to the previous month.

Source: FSA Consumer Insights Tracker (September 2022 to March 2023)

In summary

The cost of food increased on average 11% during 2022, with oil and spreads, dairy products and non-dairy alternatives, fish, eggs, meat and other proteins experiencing some of the sharpest increases and foods that are high in fat, salt and sugar experiencing smaller price rises than many other staple foods.

However, our analysis of people’s purchasing data suggests there has not been any significant shift in how we divide our spending between different food categories. Overall spending on in-home food also fell slightly last year – the first year-on-year fall for more than a decade.

Food prices became the top food concern for UK consumers in 2022, surpassing all other food-related concerns for the first time since FSA/FSS polling began. A smaller, but sizable number of people were worried about being able to afford food. People also reported making changes to what and where they ate throughout 2022 including changing what they bought or where they shopped, swapping premium or luxury items for cheaper alternatives, eating out less, and ordering fewer takeaways in an effort to reduce costs.

The number of households reporting food insecurity across England, Wales and Northern Ireland rose to 20%, the highest level since tracking began in 2016, with a further 13% of households reporting marginal food security. This suggests that up to a third of all households have material concerns about having enough food to eat. One in ten households are experiencing very low food security with regularly disrupted eating patterns and reduced food intake. A similar trend has been seen in Scotland, 40% of adults were worried about affording food in December 2022, compared to 17% in July 2020.

Approximately two-thirds of people are concerned about the cost of healthy food over the next three years and more than half feel ‘priced out’ of eating healthily. Consumers tell us in our research that they are having to make compromises on the perceived quality of their food. The publication of the forthcoming National Diet and Nutritional Survey for 2022 will help us to understand whether this is translating into any meaningful changes in people’s diets. However, it will take longer for any changes in health outcomes to become apparent.

-

This excludes beans and pulses due to unavailability of data.

-

All figures in this paragraph from ONS Consumer trends: chained volume measure,

seasonally adjusted. -

All figures in this paragraph from ONS Consumer trends: chained volume measure,

seasonally adjusted. -

Respondents were asked: Do you have concerns about any of the following?

The amount of sugar in food, food waste, animal welfare, hormones, steroids or antibiotics

in food, the amount of salt in food, the amount of fat in food, food poisoning, food hygiene when eating out, food hygiene when ordering takeaways, the use of pesticides, food fraud or crime, the use of additives (for example, preservatives and colouring), food prices, genetically modified (GM) foods, chemical contamination from the environment, food miles, the number of calories in food, food allergen information, cooking safely at home, none of these, don’t know. Respondents could select multiple responses. The percentages indicate the proportion of respondents who selected each option. -

Differences in percentages between Scotland and the rest of the UK may be due to

methodological differences in how data are collected. -

Social Grade has six possible classifications (A, B, C1, C2, D and E). Census data uses

a combined, four-way classification. C1: Supervisory, clerical, and junior managerial,

administrative and professional occupations. DE: Semi-skilled and unskilled manual

occupations; unemployed and lowest grade occupations. -

The FSA has been measuring food insecurity since 2016. In 2016 and 2018, food insecurity was measured in Food and You. Since 2020 it has been measured in Food and You 2.

-

Because of differences in the way that the data is collected, we cannot make direct

comparisons between the official USDA measure as set out in Food and You 2 and the

more informal measures of certain food insecurity behaviours tracked monthly. -

Free sugars refers to all added sugars in any form; all sugars naturally present in fruit and

vegetable juices, purées and pastes and similar products in which the structure has been

broken down; all sugars in drinks (except for dairy-based drinks); and lactose and galactose added as ingredients. -

Respondents were asked: To what extent do these areas concern you about the future of

food in the UK over the next 3 years? Cost of healthy food. Response options: Not at all

concerned, A bit concerned, Quite concerned, Extremely concerned. Reported percentage

for concerned combines ‘Extremely concerned’ and ‘Quite concerned’ responses. -

Respondents were asked: To what extent do you agree or disagree with this statement?

I feel priced out of healthy foods. Response options: Disagree strongly, Disagree slightly,

Neither agree nor disagree, Agree slightly, Agree strongly. Reported percentage combines

‘Agree slightly’ and ‘Agree strongly’ responses. -

Respondents were asked: To what extent do you agree or disagree with this statement?

It’s difficult to find fresh food (for example, fruit, vegetables, meat) that fits my budget.

Response options: Disagree strongly, Disagree slightly, Neither agree nor disagree, Agree

slightly, Agree strongly. Reported percentage combines ‘Agree slightly’ and ‘Agree strongly’

responses.

The standards of imported food and feed

At a glance

In this chapter, we look at:

- our pattern of food imports and how this changed during 2022

- the safety of our imports based on data collected at the border

- free trade agreements as the UK developers new formal trading partnerships

Introduction

Food is a global business Sophisticated trading networks support the wide range and availability of fresh produce in our shops and provide food companies with affordable access to the raw commodities – including grain, cooking oil, sugar and salt – necessary to produce manufactured goods.

Yet with more than two-fifths (42%) (footnote 1) of our food coming from overseas, any disruption to imports can have serious consequences for both consumers and the businesses that depend upon stable access to global food supplies. Equally, the UK’s trading partners must have confidence in the food we export, including in the ingredients we may have imported for producing food within the UK. Upholding the safety and standards of imported foods is therefore hugely important.

This chapter looks at where we sourced our food and feed in 2022, and what impact the disruption to the food system may have had on food standards. It sets out the checks that regulators have carried out on imported food, what they have found, and what new protections are put in place as a result of leaving the EU. We also examine what our border control data can tell us about whether the overall safety and authenticity of our imported food is being maintained.

The changing landscape of food and feed imports

Imports remained important to the UK food sector in 2022, as volumes returned to pre-pandemic levels. A total of 2.18 million more tonnes of imported food and feed came into the country during 2022 compared to the previous year (a 5.6% increase), bringing our imports back in line with the average volumes seen over the previous seven years (figures 13 and 14) (footnote 2).

Figure 13: Total UK import volumes of all food and feed over time, 2014-22

Figure 14: Yearly percentage change in total UK import volumes

We also continue to source most of our food and feed from many of the same countries as before the pandemic. There has been little change in the top 10 countries the UK imports from (figure 15), the only exception being some fluctuation in trade with South American partners.

Further down the list, however, there is greater volatility. Figure 16 shows that the conflict in Ukraine has almost entirely reversed the increases in Russian and Ukrainian imports seen since 2014. Coupled with decreased imports from Latvia and Lithuania, in all, the UK imported around a million tonnes less food and feed products from these four countries in 2022 than it did in 2021.

Figure 15: Top 10 countries by import volumes for 2022

| Country Name | Volume of imports 2022 (million kg) | Year-on-year change | 2022 ranking* | Difference in ranking |

|---|---|---|---|---|

| Netherlands |

5,521 |

33% | 1 (1) | No change |

| France | 3,769 | 26% | 2 (3) | +1 |

| Ireland | 3,349 | -3% | 3 (2) | -1 |

| Belgium | 2,875 | 24% | 4 (5) | +1 |

| Spain | 2,467 | -3% | 5 (4) | -1 |

| Germany | 2,077 | -1% | 6 (6) | No change |

| Italy | 2,038 | -1% | 7 (8) | +1 |

| Brazil | 1,784 | 65% | 8 (13) | +5 |

| Poland | 1,617 | 2% | 9 (9) | No change |

| Argentina | 1,523 | -26% | 10 (7) | -3 |

* 2021’s ranking is in brackets.

** Imports from the Netherlands reflect the effect of Rotterdam as a global hub for transporting goods.

Figure 16: Changes in import values across selected countries

| Country name (ranking) | Volume of imports 2021 (million kg) | Volume of imports 2022 (million kg) | Volume percentage change from 2021 to 2022 | Pre-war growth in imports (2014 to 2021) |

|---|---|---|---|---|

| Bulgaria (46) | 70 | 119 | 70% | 120% |

| Estonia (62) | 133 | 44 | -67% | 84% |

| Latvia (35) | 296 | 169 | -43% | 41% |

| Lithuania (30) | 347 | 248 | -29% | 96% |

| Romania (19) | 102 | 451 | 340% | 8% |

| Russia (55) | 173 | 70 | -60% | 16% |

| Turkey (16) | 555 | 562 | 1% | 49% |

| Ukraine | 1,175 | 474 | -60% | 87% |

By contrast, there have been some sharp rises in imports from other South Eastern European countries, albeit from a lower base, including a 340% increase in import volumes from Romania and a 70% increase in those from Bulgaria compared to the previous year. This has elevated Romania from being our 48th largest import country in 2021 to one of the UK’s top 20 biggest food suppliers in 2022 (currently 19th) (figure 16). It is usual to see a certain degree of volatility in the flow of goods into the UK as importers react to changing market conditions.

Commodity changes

Our food import data is broken down into three main commodity types: Products of Animal Origin (POAO), which includes meat, eggs, fish and dairy; Food Not of Animal Origin (FNAO), which includes beverages, cereals, vegetables and fruit; and Animal Feed. In general, we assign a higher level of food safety risk to POAO, although there are still risks from FNAO, such as aflatoxins in nuts.

Figure 17 shows the total volume of imports in 2022 split by these categories. It shows that FNAO makes up the bulk of our food imports by weight, while POAO and feed imports are similar to each other by weight. We import a higher proportion of POAO from the EU than FNAO or Feed, although the EU provides more than half of each group.

Figure 17: Total volume of imports split by main categories of POAO, FNAO and animal feed

| Import Category | Total in 2022 (tonnes) | Volume change 2019-2022 | Volume change 2021-2022 | EU proportion 2022 |

|---|---|---|---|---|

| Products of Animal Origin (POAO) | 7,000,000 | -5% | 10% | 80% |

| Food Not of Animal Origin (FNAO) | 29,000,000 | -1% | 7% | 64% |

| Feed | 6,000,000 | -13% | -7% | 51% |

| Grand Total | 42,000,000 | -4% | 6% | 65% |

Note: two reference points have been included in the table above to provide a relative snapshot of comparable change against what could be considered a more stable period (2019), followed by year-on-year change (2021) which would have seen the impacts of the UK’s departure from the EU and the pandemic.

How safe is imported food and feed?

The food we import must be safe. This is one of the reasons why having effective border controls for all imported foods, including those sourced from EU member states, is critical. As we have seen, the EU still accounts for two-thirds of all food and feed imports, and 80% of all meat and other products of animal origin (figure 17).

All food and feed imported from outside the EU is subject to a series of checks to make sure it is safe. The type of checks carried out depends on the type of product and the level of risk it may pose to public, animal and plant health.

Currently, all food and feed of animal origin coming from outside the EU is subject to documentary checks (which confirm that appropriate documentation is supplied) and identity checks (which confirm that the product matches the documentation). Additional physical checks are carried out randomly on a pre-defined percentage.

FNAO are generally considered to be low risk. When specific risks are identified – for example, if sampling identifies a typical risk from a specific country or on a specific commodity that requires additional controls to be imposed – they will be classified as high-risk and will be subject to appropriate controls.

Under current operating arrangements for Northern Ireland, food and feed products imported into Northern Ireland will continue to follow EU rules. From Autumn 2023, the Windsor Framework will allow GB standards for public health, marketing (including labelling) and organics to apply for prepacked retail goods moved via a new Northern Ireland retail movement scheme and placed on the Northern Ireland market. Therefore, goods moving via this route containing products subject to import controls in GB will be able to be placed on the Northern Ireland market.

Figure 18 shows the vast majority of non-EU goods were compliant across these three checks (documentary, identity and physical), with no obvious changes against these measures. This suggests that the risk to consumers from non-compliant consignments from non-EU countries had not increased.

The situation is less clear for products coming in from EU member states. Until the new import rules defined by the Border Target Operating Model are phased in, border controls are not being applied to EU-origin products entering the UK - although a new requirement for importers to pre-notify border authorities of consignments of high-risk goods (from all EU countries except Ireland) was introduced on 1 January 2022.

For the period covered by this report, therefore, there continued to be no import controls routinely applied at the border for EU food and feed products and, although the probability of any significant increase in risk is low, this means that FSA and FSS are not able to say how the food safety risk from EU products has changed in recent years.

Figure 18: Percentage of rest of world consignments failing import checks in Great Britain, 2021-22

Documentary checks

| Consignment type | 2021 | 2022 |

|---|---|---|

| Meat and other animal products (POAO) | 0.91% | 0.91% |

| Other high risk foods (HRFANO) | 0.54% | 0.31% |

| All consignments | 0.84% | 0.78% |

Identity checks

| Consignment type | 2021 | 2022 |

|---|---|---|

| Meat and other animal products (POAO) | 0.84% | 0.63% |

| Other high risk foods (HRFANO) | 1.94% | 1.16% |

| All consignments | 0.87% | 0.65% |

Physical checks

| Consignment type | 2021 | 2022 |

|---|---|---|

| Meat and other animal products (POAO) | Not available* | Not available* |

| Other high risk foods (HRFANO) | 4.31% | 2.60% |

| All consignments | (NA) | (NA) |

Sampling (as part of a physical check)

| Consignment type | 2021 | 2022 |

|---|---|---|

| Meat and other animal products (POAO) | 0.99% | 0.93%** |

| Other high risk foods (HRFANO) | 4.78% | 4.13% |

| All consignments | 2.76% | 2.44% |

* Since leaving the EU and moving to the import of products, animals, food and feed system (IPAFFS), the functionality of the system records only the outcome of sampling checks undertaken which accounts for the figures as seen above

** 21 Results pending out of over 1,000.

Changes to designation of high-risk food and feed not of animal origin

As already mentioned, the UK takes a risk-based approach when it comes to border checks of imported food. All animal products are subject to checks as well as some food of non-animal origin. Certain non-animal origin products may pose a public health risk due to potential contamination with pesticides, naturally occurring toxins (aflatoxins), heavy metals or harmful microbes such as Salmonella. These risks can change quickly due to weather conditions, farming practices and production techniques, and vary between different countries of origin.

The UK’s departure from the EU means that FSA and FSS now have responsibilities to target specific risks to consumers by assessing and amending the list of High-Risk Food Not of Animal Origin (HRFNAO) in GB. We have conducted new analysis to help make the list more relevant to the food we eat and our own assessment of the risks they carry.

As a result, during 2022, FSA and FSS advised ministers to add five new product types to the existing list of HRFNAOs and to increase check levels on 13 more. Several of the additions to the list were due to concerns about the presence of pesticide residues, which may partly be due to the excessively dry conditions experienced in some countries leaving more residue on crops.

Extending the range of HRFNAO commodities that we control at the border increases our knowledge of the exporting countries’ compliance with our food safety requirements and can be used in any future risk assessments we might undertake. It also sends a powerful message to exporting countries that our controls are robust and that we will target non-compliant imports at the border.

FSA and FSS also advised ministers that three products should be removed from the list entirely following a risk assessment which showed they are compliant and no longer pose a risk to public health. In addition, we have reduced inspection checks on five other products as the risks associated with them were now less likely to cause harm. These are described in figure 19.

Figure 19: Changes to designation of high-risk foods

Imported HRFNAO commodities that have been risk assessed and removed from control at the border as they are compliant with imported food safety requirements and no longer a risk to public health

| Commodity | Country | Hazard |

|---|---|---|

| Goji berries | China | Pesticide residues |

| Dried grapes | Turkey | Ochratoxin A |

| Pistachios | USA | Aflatoxins |

Imported HRFNAO commodities that remain under control, but we have noted a declining risk/ improvements in compliance with imported food safety requirements

| Commodity | Country | Hazard |

|---|---|---|

| Groundnuts | Brazil | Aflatoxins |

| Groundnuts | China | Aflatoxins |

| Hazelnuts | Turkey | Aflatoxins |

| Betel leaves (Piper betle) | Bangladesh | Salmonella |

| Hazelnuts | Georgia | Aflatoxins |

Imported FNAO commodities that have been identified through our surveillance intelligence systems as presenting a risk to public health and have been brought under control at the border for the first time

| Commodity | Country | Hazard |

|---|---|---|

| Groundnuts | Brazil | Pesticide residues |

| Lemons | Turkey | Pesticide residues |

| Betel leaves (Piper betle) | Thailand | Salmonella |

|

Peppers of the Capsicum species (other than sweet) |

Turkey | Pesticide residues |

| Sesamum seeds | Uganda | Salmonella |

Imported HRFNAO commodities that have had controls increased at the border due to increased non-compliance / risk to public health Commodities that are moved into Annex 2 have additional import requirements attached to them, the commodity must be accompanied by an Export Health Certificate and subject to laboratory testing to indicate compliance with GB food safety requirements

| Commodity | Country | Hazard |

|---|---|---|

| Black pepper (Piper nigrum) | Brazil | Salmonella |

| Peppers of the Capsicum species (other than sweet) | Thailand | Pesticide residues |

| Okra | India | Pesticide residues |

|

Oranges |

Turkey | Pesticide residues |

| Mandarins, clementine, Wilkings (mandarin variety) and similar citrus hybrids | Turkey | Pesticide residues |

| Jackfruit | Malaysia | Pesticide residues |

| Peppers of the Capsicum species (other than sweet) | Uganda | Pesticide residues |

| Sweet Peppers (Capsicum annuum) | Turkey | Pesticide residues |

| Sesamum seeds | Sudan | Salmonella |

| Vine leaves | Turkey | Pesticide residues |

| Sesamum seeds | Ethiopia | Salmonella |

| Peppers of the Capsicum species (other than sweet) | Sri Lanka | Aflatoxins |

| Groundnuts | India | Alflatoxins |

Border notifications and Intensified Official Controls

The UK’s departure from the EU has also changed what happens when there is a breach in import food standards. When a consignment of a product has failed its checks, the UK issues an alert to enforcement authorities to target similar imports. A total of 326 border notifications were issued in 2022, the first year since this new system was put into practice, summarised below.

Top four reasons for Border Notification Failures

- 126 related to either documentary/identity failure

- 33 related to physical failures (such as spoilage, a different commodity identified to that described on import certificate or on IPAFFS, or extraneous matter)

- 58 related to mycotoxin (aflatoxin and ochratoxin failures)

- 29 related to pesticide failures

For imported animal products, if border officials find there are repeated or serious breaches in GB’s import requirements, future consignments from the food business involved may be subject to intensified official controls (IOC). Under these rules, imports of all consignments from an establishment subject to an IOC would be subject to physical check until the IOC is lifted. FSA notifies the authorities in the country of concern, so that they may take action to resolve the problem.

Overall, non-EU imports have remained largely compliant with import checks compared with last year This suggests there has not been any significant fall in the safety of our imports, though the picture remains limited without similar controls on EU imports Our border notification system and ability to apply intensified controls enhances our ability to target specific risks and areas of non-compliance to protect UK consumers from harm

In 2022, the IOC process was used on 11 occasions due to repeated or serious threats to public health. Of the 11 IOCs created:

- Five were specific to poultry establishments in Brazil due to products being contaminated with Salmonella

- Three were related to veterinary medicine residue failures in establishments from Bangladesh, India and Vietnam

- A failure for Gyrodactylus salaris (parasitic worms) from an establishment in Morocco

- Sulphur dioxide failure (in edible gelatine) from an establishment in Pakistan

- A species verification failure (physical check contradicts the health certification) from an establishment in China.

2022 was the first full year of the IOC process and so comparable data is not yet available.

Free Trade Agreements and health protection

As the UK develops new formal trading partnerships with countries outside the EU, it is important that statutory protections are in place to uphold the safety standards of food imported under these Free Trade Agreements (FTAs).

The UK has already signed new FTAs with Australia (in December 2021) and New Zealand (February 2022) which came into force in early 2023. Section 42 of the Agriculture Act 2020 requires the UK Government to explain if the protections for agricultural products set out in UK law are maintained.

As part of this, FSA and FSS were asked to examine if both FTAs maintained UK food safety protections. Broader issues relating to the FTAs which are outside of the remit of FSA and FSS (such as tariffs and the potential impact on trade flows over time) were not within the requested scope of our advice: the mandated focus of our report was human health statutory protections.

We looked at whether changes to the UK food regulatory system were needed to comply with the FTA, and if there would be an impact on the UK government and devolved administrations to regulate in areas of food safety and nutrition (defined as: nutrition and health claims; vitamins, minerals and certain other substances; food supplements; and foods for specific groups).

Both FSA and FSS concluded that the FTAs with Australia and New Zealand did uphold food safety protections for the consumer. Additionally, for the New Zealand agreement, we assessed whether it maintained UK nutrition requirements and concluded that it did. We will continue to scrutinise any future agreements and these assessments will continue to include consideration of nutrition statutory protections.

Understanding food production standards

FSA and FSS also recognise that consumers are interested in understanding the production standards of imported foods, including their environmental and animal welfare standards.

To support this, the FSA recently commissioned the food consultancy ADAS to identify measurable metrics and data sources for imported food production standards that might be used to give the public a fuller picture.

However, the ADAS report highlighted:

- a general lack of publicly available data and issues with the quality of the limited data available

- a lack of measurable metrics or clear approaches to measure or monitor them

- the absence of frameworks to evaluate production standards.